Sector Analysis : Ferro Alloy a proxy on Steel

We are talking about Ferro Chrome – an alloy whose demand is linked to Steel!

Watch this video to understand the complete value chain:

Ferro Chrome are a type of alloys called as FERROALLOYS. Ferroalloys are important inputs for steel industry as these are used as deoxidizers and alloy additives in the steel manufacturing process .These alloys impart special properties to steel for ex: increase resistance to corrosion, improve hardness & tensile strength at high temperature, impart wear and abrasion resistance and increase creep strength etc.

There are three sub segments in ferroalloys

Silico Manganese

Ferro Manganese

Ferro Chrome

The growth of Ferroalloys Industry is thus, linked with the development of Iron and steel Industry.

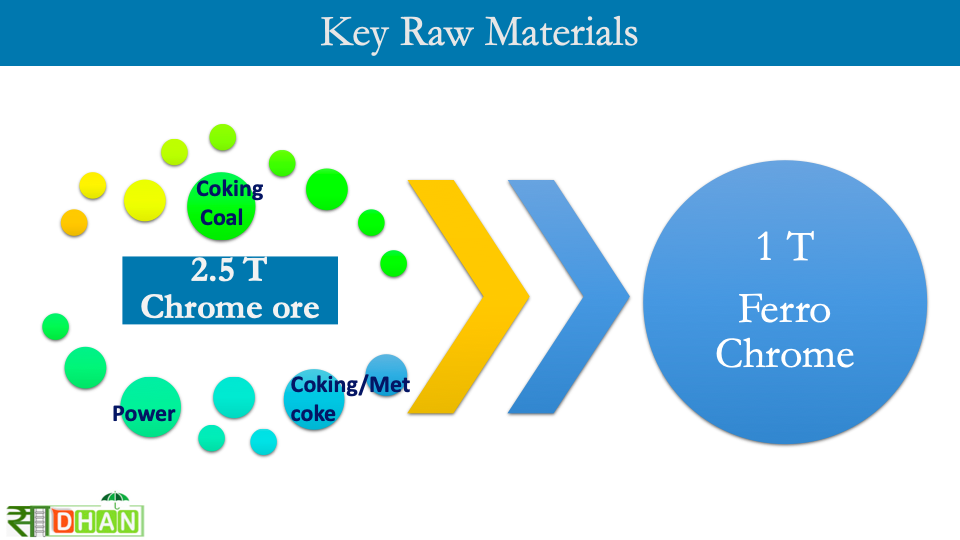

One interesting thing to note for an Investor is that : This sector is high energy intensive sector. It means power requirement to make 1 ton is very high. Ferroalloys Industry spends 40 to 70% production cost on power consumption. The power consumption per ton of ferroalloys production in the country varied from 3,000 to 12,000 kWh as shown below:

FERROCHROME

Ferrochrome when added to stainless steel to enhance its appearance and impart corrosion

resistance. For every ton of stainless steel (depending on the grade), there is 17-23% of chrome

content is required. Hence, if the stainless steel industry grows, the ferrochrome industry also

grows. Ferrochrome is produced by electric Carbothermic Reduction of chromite.

Ferrochrome Demand

Ferrochrome market size is projected to reach USD 19150 Million in 2022 and is forecast to readjusted

size of USD 31070 Million by 2028 with CAGR of 8.4% during the review period. As it is a proxy on steel demand so let us understand first the demand drivers of steel sector.

International Steel demand

Steel demand shall remain high as in order to beat Covid most of the countries have to deploy funds into infrastructure building and infrastructure development without steel is virtually impossible. So there will be a huge demand of steel in market. Chinese Lunar new year is about to end so China will start producing and demand from china will increase.

Domestic Demand

Following the fresh lease of mines, the players have to pay a high premium for extraction of ore for majority of the production in India. This is likely to push up cost of extraction and keep ferro chrome prices firm.

Indian Govt. Steel Policy

India has 100 million tonne capacity at present and has planned to grow 300 tonne per annum. We will

see a growth in coming years basis the Key Targets detailed below:

Domestic crude steel capacity is to be 300 million tonne by 2030-31 (122 million tonne in 2015-

16) entailing an investment of Rs 10Lakh Crore.

Steel Demand estimated at grow 3-fold to 212 to 247 million tonne by 2030-31.

Per Capita Consumption of steel to go up to 160kg by 2030-31 (from 61kg now).

India to emerge as net exporter of steel by 2025-26.

To domestically meet entire demand of high-grade automotive steel, electrical steel, special

steels and allow for strategic applications by 2030-31.

Ferro Chrome prices

When there is increase in steel prices there will be increase in ferrochrome simultaneously. But in October 2021 there is decrease in its prices (25% correction) due to Chinese Lunar New Year, as in this

month they produce as well consume it in its own country. It affected the market because 50% majority

of steel market is controlled by China. Global Stainless Steel companies are shopping for Ferrochrome in

very limited reserves in the market. Consumers are accepting higher offers and willing to pay premiums.

Price Outlook

Domestic ferrochrome demand this week was sluggish due to buyers reluctance to book at

higher levels. Domestic offers, therefore, remained stable. In addition, ferro chrome prices also

remained stable due to muted Chinese demand owing to the Lunar New Year holidays.

In addition, the cost of ferro chrome production has increased due to a hike in coke prices in

India – up by 11% m-o-m to INR 51,000/t from eastern region. This prompted smelters to raise

that offers, but buyers refuse any further hike due to unacceptable high prices.

Additionally, UG2 chrome ore prices increased to $185/t CNF China as Chinese inventories

dropped to 3 million tonnes (mnt) from 4 mnt and producers expect robust demand after the

New Year holiday. So, an increase in chrome ore prices also supports ferro chrome prices.

Indian ferrochrome smelters are optimistic in terms of ferro chrome prices and demand as they

are anticipating good demand from Chinese buyer post-the New Year holidays.

Three Reasons Supporting High Prices

- South Africa: South Africa having 60% of Market Share and it is the Price Setter. Power

Supply in South Africa has been a perennial issue from many years. Since 2008, South Africa has been facing power deficit. Currently they are running a deficit of 4000 MW (Power shortage of 4000 MW ) hence they are planning to raise power rate, and as we know this industry is totally dependent on power sector, so if there will be a hike in Power cost in South Africa then globally prices of ferro chrome will be high. As South Africa produces ore and Chinese company import ore and ferroalloy spelter situated in China supply Stainless steels from there, South African local spelter was against it as they are not in favor of South Africa economy. So they have tried to bring a legislation which they have proposed in budget. 20.5 % is the price increase applied for by ESKOM from 1st April 2022 for electricity. The Govt is considering a Tax on export of Chrome Ore which is still not announced as SA budget is on 23rd February 2022. - Kazakhstan: In Kazakhstan there is civil unrest is going on so it may affect production.

Kazakhstan also controls more than 10% of international ore supply. - Turkey: Turkey is major exporter of European countries. Prices of ferrochrome in Europe is

already high because turkey is unable to supply to them due to its own problems

- Conclusion

From Supply side these are the three factors as they are geopolitical in nature and from Demand side Lunar New year is going to end soon then China will start producing, demand from china will high so prices are going to be elevated for near term.If all these factors come into picture then prices shall go up in short term. - We think an Indian domestic company named IMFA Ltd is placed to benefit from this . Watch the video to know more:

Mark

September 5, 2022 at 7:47 pm

Thanks for your blog, nice to read. Do not stop.